Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

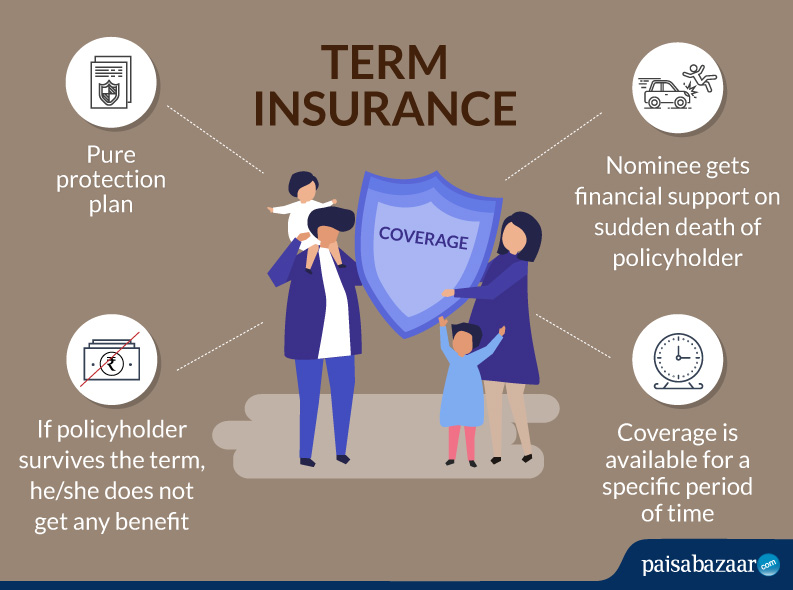

A Term Insurance plan is a form of life cover which is provided for a definite period and if the insured happens to expire during the tenure of the policy, then the death benefit will be payable to the nominee. Term plans are designed according to the needs of families in case of death or even uncertainty. It provides a specific amount for coverage for a specified period. The premiums provided in term insurance plans are the lowest compared to all other insurance plans. The premiums are low because there is no investment opportunity in term insurance and the entire money goes to benefit the risk.

If the holder dies during the tenure period, then the benefit amount goes to the nominee instantly. There is no kind of maturity benefit included if the term expires. There may be plans to pay maturity benefit provided the condition that the holder survives. Some factors to keep in mind while choosing policy terms are listed as under:

The minimum age of entry for taking an insurance plan is 18 years and the maximum age limit is 65 years.

There is a conversion facility in the term insurance plan. You can either convert it to a whole life insurance policy or an endowment plan during any time of policy tenure without any additional charges.

According to LIC, if you missed the premium, then there is a grace period of 30 days where the premium mode of payment is monthly or half-yearly and 15 days when it is the monthly payment.

Premiums under all life insurance plans are exempted up to a maximum of Rs. 1 lakh under Sec 80C of Income Tax Act, 1961. The claim that is received by the beneficiaries is tax-free under Sec 10(10D) of Income Tax Act, 1961.

A participating policy is one in which the policyholder shares the profits of the company which is dependent on the investment returns. A non-participating policy is one in which there is no kind of profit sharing.

Read here is details the benefits of Term Insurance Plan

The insurance plan can be exited before the maturity of the plan. The charges would be deducted on policy to policy basis. No charges would be required if the surrender is done after 5 years.

If the holder surrenders the policy early that is 3 years from the time of taking it, then surrender value would be 30% of the premiums paid. Some insurance companies tend to eliminate the surrender amount during the 1st year only.

The premium in term plan varies from company to company and as the tenure increases, the premium of the sum assured increases.