Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

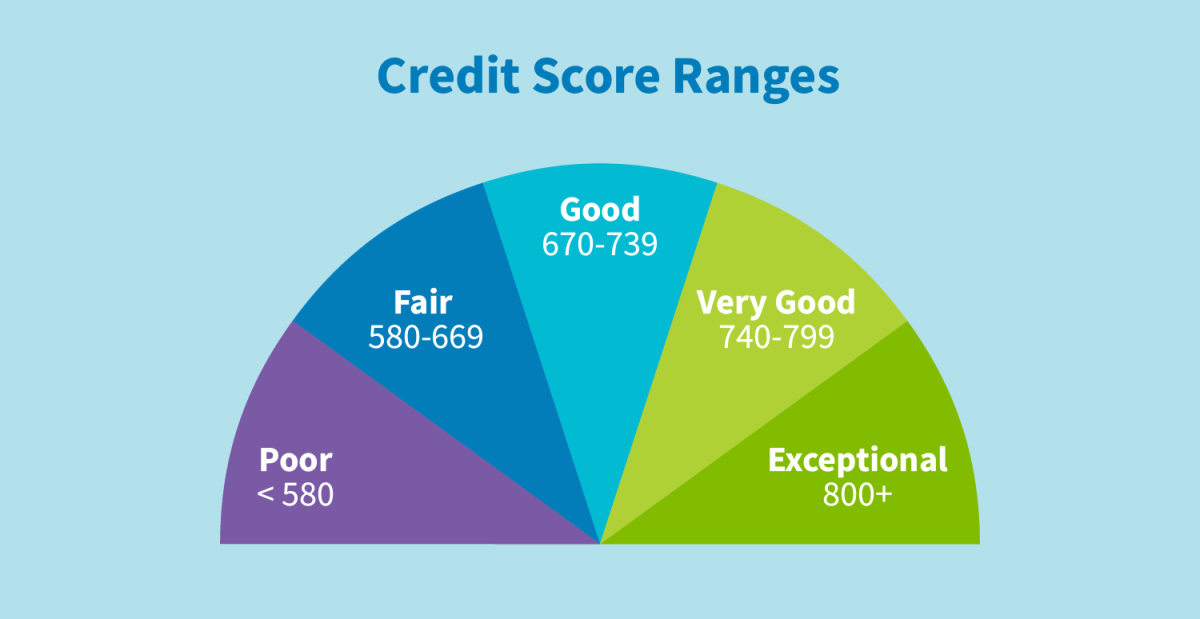

A good credit score is a major key to achieving credit cards from banks. The normal credit score ranges from 300 to 850. With a good credit score, you can get competitive loans and mortgage amounts at the best rates. The moment you apply for credit, the lenders will review your credit report to check out your credit and it has an inclusion of the three-digit number technically known as the credit score. The two main credit rating sources are Vantage Score and FICO.

A good credit score depends on the model used for credit scoring and the credit bureau that helps in pulling the credit scores. In the case of FICO score:

According to VantageScore, the reports are:

Credit scores are very essential numbers that decide whether you can get a credit or not. The credit scores determine whether you can pay for your loans and get loans in the first place itself. Protecting your credit score is very important and these are some of the factors that determine your credit rating score:

About 30% of your debt level determines whether you will get loans or not. FICO looks into certain matters like the overall debt, the ratio of the credit card balance, and how much time you can repay your loans. As per limits, keep your credit card utilization below 30%. High balances mean that it can affect your credit score heavily.

Having revolving accounts and installment loans is profitable for having a good credit score. It means you are dealing with all types of credits. If you are planning a good credit score, apply for loans to different assets like a car or home. You can also apply for a student or personal loan for a better impact. The types of credit consume only about 10% of your credit score, so having different types is not going to affect you in any way.

The history of your credit score also matters a lot. When you calculate the score, it is 15% of your credit score and is the consideration of both average age and oldest accounts. An old credit score works in your favor because it shows your experience in handling credit. Having too many accounts adversely affects your credit score and lower credit age. So, it is good at attaching to a single account and not going for several accounts at the same time.

Payment history is an essential criterion and affects almost 35% of the credit score. Your timely payments determine your score. Some issues like bankruptcy, tax liens, foreclosures, can affect your credit score badly. With these issues getting a good credit score is not possible. So, try to keep these issues by making all your payments on time.

Every time you make a credit inquiry, it shows in your credit-based application. Inquiries take up about 10% of the credit score. Making around one or two inquiries won’t hurt much but making too many inquiries at the same time can hurt credit score. Make your applications a minimum for preserving your credit score. The only good thing is that all the inquiries you made in the last 12 months will be reflected in the credit score. All of the inquiries disappear themselves after 24 months.

The advantage of a good credit score is that banks are always willing to give you more money as you have paid all the taken money in time. There are chances that you will get to make money on credit even with a bad record, but then the amount will be limited and you cannot ask for more.

People having low credit scores find it difficult for applying for new loans as they have been rejected from the previous ones. Lenders do consider factors like income and debt while dealing with credit cards. Good credit scores lead to an increase in chances of getting credit. In this way, you can apply for loans with confidence every time.

There is an option of auto insurance to all the insurers who try using bad credit scores to bring your credit limit down. All the insurance companies make use of the credit reports and insurance risk scores before going ahead with giving insurance rates. They are often seen penalizing people having low credit scores. You can avail car insurance rates once you have a good credit score and this will lead to the payment of less insurance.

The interest rates are the cost you pay instead of borrowing money and good interest rates are related to good credit scores. If you have maintained a good credit score, then you qualify for better interest rates. You will have to pay low financial charges on loans and credit cards. Interests should be lesser in an amount to help you deal with payment of full debt on time.

Lenders try to stay away from people with low credit scores and they do not prefer giving phone numbers to them. Pay extra until the time you have made a good image of yourself with the provider. People having good credit scores do not pay security deposits and they always receive discounted purchase price on their phones simply by signing a contract.

Having a good credit score is something to be proud of and you have all the right to brag about it. If you have never experienced a bad credit score, then keep up with the good work and try to maintain the level.

These are some of the tips one should know when dealing with credit cards and credit scores. Work towards your betterment and maintain a good credit score however possible.