Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

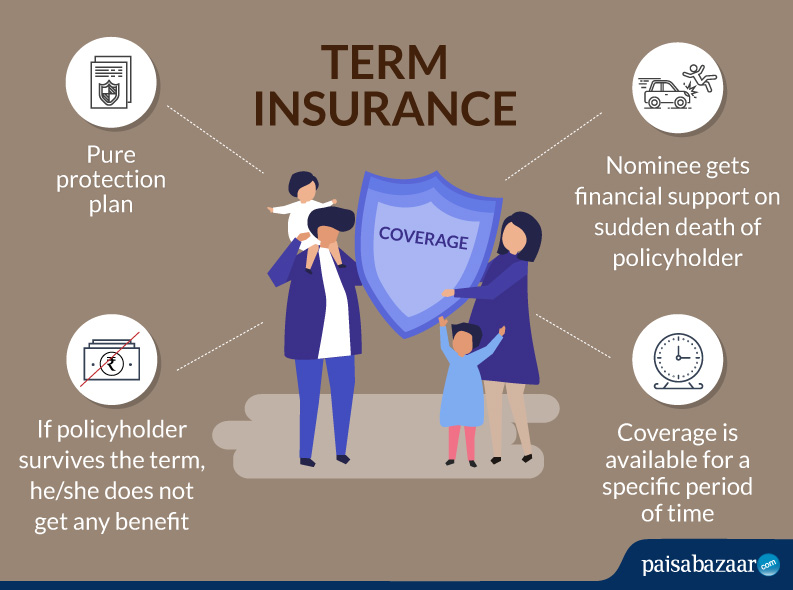

Life is short and no one knows what will happen in the next moment. To protect your family financially, opting for an insurance plan is the best thing. Term insurance plans are best because it asks for low premiums and the family gets the entire assured amount on death of the holder. Few things to keep in mind the term insurance plan are:

The term insurance plan should provide the family with adequate income on the uncertain death of the holder.

The tenure should be able to cover the span of the individual related to work. The term insurance should maximum be of 65 years. Some reason on why one should buy a term insurance plan are listed as under:

Flexibility is one of the main things when it comes to insurance plans. You are being given a choice to select any online or offline plans and health plans are not mandatory. You can change and customize the plan as per your needs.

The premiums are very low in terms of insurance plans as compared to all other insurance plans. An individual only has to pay one percent of his annual income to have the term cover. Since the element of the premium is not there in the insured plan, the premium is quite less and no one has to worry about paying it.

When you plan of buying any term plan, you need to disclose correct facts about health, finances, etc. As per IRDA regulations, no insurance company can claim that there has a non-disclosure of facts after 2 years of policy coming into action.

An unfortunate death is very bad and leaves the family in a really bad state if there is only one earning member in the family. To prevent any such thing from happening, you can always invest in a term insurance plan. It is the best way to take care of the financial needs of your family without having to ask anyone about the money.

Riders are the additional benefits that come with the policy to suit the requirements of the policyholders. Some riders can be taken at the time of certain critical illnesses, partial or permanent disability or death due to accidents. Riders should be bought only in case of genuine reasons and the offer document should be read carefully before taking riders.

Normally if you buy a premium, it charges for brokerage fees. But if you buy an online term plan, then you do not have to pay any brokerage charges at all. This way you save about 5-6 % of the savings of your income.

These are some of the benefits of buying term insurance. Term insurance plans take care of many needs like burial expenses, education, and other family expenses. Take a wise decision as life is very uncertain.